The Ins and Outs of

Medicare in 2023

Medicare in 2023

Posted by Morgan Fisher

Serving Cedar Rapids, Iowa, and Surrounding Areas.

The Ins and Outs of Medicare in 2023

As you get closer to 65-years-old, you will quickly realize that Medicare can be one of the most maddening things you will have to deal with in retirement. Questions that may come to mind include, when and how to enroll, which parts to enroll in, or even which plans to select. You may have heard of things like Part A, Part B, Part C, Part D, or even Plan G, medigap plans or Advantage plans.

Determining what is important to you can be difficult. Here is a list of 7 essential things to know, to help you navigate the Ins and Outs of Medicare.

The Parts of Medicare

First, let’s get the different parts of Medicare out of the way. You have paid into Medicare Part A through your working years, so it’s free. Part A will cover hospital services. Part B comes with a cost of $164.90/month for 2023. Together, Part A & Part B will cover 80% of your total health costs.

Next, we will skip to Part D, the prescription-drug coverage. This will be a plan chosen that is unique to your zip code and prescription drugs. In the state of Iowa, premiums can range from $7.50- $113.60/month. Other things to consider when choosing these plans may include co-payments, deductibles, and other out-of-pocket costs.

Covering the Gaps

As you now know, together Medicare Part A & B will cover 80% of your health costs. Meaning-it is up to you to find a way to cover the additional 20% gap. There are two ways to do this, Original Medicare (medigap) or Medicare Advantage plans.

Original Medicare

Original Medicare consists of a handful of Plans, ranging from Plan A to Plan N. Each Plan is designed to cover your deductibles, co-payments, and other gaps just slightly different. The thing you need to know about this is that each plan is uniform throughout the United States. Whether you go with a well-known company like Blue Cross Blue Shield or a less known company like Medico, the benefits will be the same for each plan. The thing that is different, the cost.

When you hear about Plans, some of the more popular ones you may read about are Plans G, N, or even F. Back in 2020 however, Plan F was phased out. Don’t worry though, if you turned 65 prior to 2020, you are still eligible. Today, the most common plan is a Plan G. This plan will cover everything for you, minus a $226 deductible for the year. Here at Iowa Retirement Benefits & Solutions, this is our most popular plan. Why? Because it is cheap, and it will protect you even in your most horrendous health years! Curious what you would pay? Check it out.

Things to consider with this route include a budgeable monthly premium as well as the ability to travel to see any doctor, in any network.

Sidenote: if you go with this route, you will also need to get a prescription drug coverage plan (Part D).

Medicare Advantage

Medicare Advantage is the other way you can cover the additional 20% of your healthcare costs. Going this route allows for a monthly premium of $0. However, doing it this way will come with co-payments and deductibles in the event you use this plan. I like to think of this plan as a pay as you go plan. If you have a tough year with your health, you can expect around $4,000 for the entire year. However, if you have a great year of health, you may pay $0 the entire year. A bit like gambling if you ask me! Other things to consider with this route include networks within your plan. In the Cedar Rapids area, companies like Aetna, United Health Care, and Humana are most popular for this type of coverage.

On top of this, Medicare Advantage Plans often get their hype based on the extras that they provide for free. Around Cedar Rapids, things like prescription drug coverage, dental, vision, hearing, and OTC benefits are most often paired with your Advantage Plan. If these are important to you, this may be the route to think about for you.

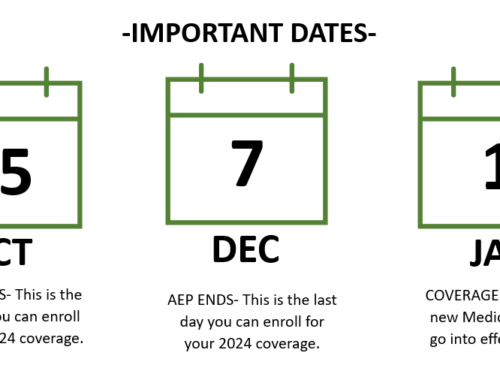

When to Enroll

Now you have learned the two routes of Medicare- let’s talk about when to start! For most, three months prior to your 65th birthday you will want to begin the process of enrollment. If you are already drawing social security, you will automatically be enrolled in Parts A & B. If you decide you do not want to take Medicare Part B because you will already be covered elsewhere, you will need to decline coverage. This can be done via ssa.gov. Not sure what route is best for you? We can help.

How to Enroll

At the three-month mark, things start to move fast. Once you have reached this point, it’s time to start enrolling in a Medicare Supplement or Medicare Advantage plan. At Iowa Retirement Benefits & Solutions we recommend that you sit down with a professional to truly understand each part of Medicare as this is not a choice you want to regret. This professional will also be able to help you get set up on a cost-effective plan and ensure a seamless transition to Medicare.

Ready to Roll

Once you have received your red, white and blue Medicare card that has both Part A and B on it, set up a supplement or Advantage plan and found a way to cover your prescription drugs, you are ready to roll!

Even after reading all of this, you may still be confused. Medicare is one of the most maddening transitions you will make. Reach out to a local representative for your customized review today.

Written by: Morgan Fisher