Speaking to a Fiduciary

Speaking to a Fiduciary

Posted by Jeff Carey

Serving Cedar Rapids, Iowa, and Surrounding Areas.

“I Waited Too Long to Plan for Retirement—What Should I do Now?” Speak to a Fiduciary

Don’t worry—you’re not alone. Many near-retirees realize late in the game that their retirement planning needs urgent attention. The good news is, it’s never too late to take meaningful action. With the right guidance, you can still secure a comfortable, stable retirement and regain peace of mind.

Why It’s Never Too Late to Start Retirement Planning

Facing retirement without a comprehensive plan can be overwhelming and emotional. You might feel anxious about your financial future, especially if retirement seemed far off when you started. But every step you take now can positively impact your future, reduce stress, and bring clarity to what once felt uncertain.

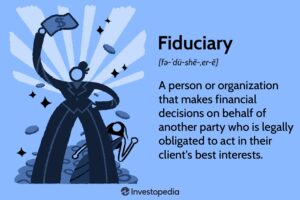

The Critical First Step: Consult a Fiduciary Financial Advisor

A trusted financial advisor or fiduciary is essential when you’re catching up on retirement planning. Their legal obligation to act in your best interest makes them a reliable partner during this critical time. Here’s what you can expect when working with a fiduciary:

Comprehensive Retirement Financial Assessment

Understanding your entire financial picture is key to crafting an effective plan. Your advisor will review:

- All income sources: Social Security, pensions, part-time work, other income streams

- Assets and liabilities: Savings, investments, home equity, debts

- Monthly expenses and spending habits

- Insurance policies: Health, life, long-term care

- Estate planning documents: Wills, powers of attorney, trusts

Why it matters: This holistic review allows your advisor to personalize strategies that align with your financial realities and retirement goals.

Developing a Retirement Income Strategy

Ensuring your money lasts throughout your retirement is paramount. Your advisor will help you:

- Decide the optimal age to claim Social Security for maximum benefit

- Build a sustainable withdrawal plan from your savings and investments

- Consider income-generating options like annuities (only if suitable and unbiased)

- Explore additional income strategies to reduce the risk of outliving your money

Key benefit: A clear, customized plan provides peace of mind and financial security.

Risk-Managed Investment Management

Protecting your savings is crucial as you approach retirement. Your advisor will:

- Tailor your investment portfolio to your retirement timeline and risk tolerance

- Rebalance investments proactively

- Shift toward conservative, income-focused investments when appropriate

Why it matters: They focus on preserving your wealth—not chasing unpredictable returns—so your nest egg remains protected.

Tax Optimization Strategies

Reducing tax liabilities can significantly boost your retirement savings. Your advisor can assist with:

- Tax-efficient withdrawal strategies

- Managing Required Minimum Distributions (RMDs)

- Converting traditional IRAs to Roth IRAs for tax-free growth

- Identifying deductions and credits available to retirees

Result: Saving thousands of dollars over the long term, enhancing your retirement income.

Estate and Legacy Planning

Planning how your assets are passed on is vital for peace of mind. Your advisor can help you:

- Structure your estate to avoid probate when possible

- Keep beneficiary information current

- Maximize your legacy through charitable giving or efficient wealth transfer

Healthcare & Long-Term Care Planning

Medical expenses often become a significant part of retirement planning. Your advisor will guide you on:

- Choosing the right Medicare and supplemental health plans

- Evaluating current healthcare coverage options

- Considering long-term care insurance or alternative funding methods

- Preparing for healthcare costs not covered by insurance

Creating a Realistic Budget & Spending Plan

Financial stability relies on smart spending. Your advisor will assist in:

- Developing a budget aligned with your lifestyle and savings goals

- Identifying and reducing unnecessary expenses

- Building or replenishing an emergency fund

Taking Action Today: Your Path to Retiree Confidence

It’s never too late to make strategic, impactful decisions. The sooner you act, the better your financial confidence and emotional well-being will be.

Ready to Secure Your Retirement? Let’s Talk!

The team at Iowa Retirement Benefits & Solutions is dedicated to helping individuals and couples navigate late-stage retirement planning. We’re here to provide personalized guidance tailored to your unique situation.

Remember: It’s possible to improve your retirement outlook, even if you started late. Let’s work together to turn your retirement around today.

Schedule a free and confidential strategy discussion today!

Email us at info@iowaretirementsolutions.com

Call us at 319-423-3332

Click here to schedule your free consultation.

Investment advisory services are offered through Fusion Capital Management, an SEC registered investment advisor. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration is not an endorsement of the firm by the commission and does not mean that the advisor has attained a specific level of skill or ability. All investment strategies have the potential for profit or loss.