Building Your Financial

Roadmap

The Crucial Role of Financial Representatives in Retirement

Posted by Morgan Fisher

Serving Cedar Rapids, Iowa, and Surrounding Areas.

Building Your Financial Roadmap

As you begin spring cleaning, it’s a prime moment to reflect on your financial journey and assess the progress of your goals set earlier this year. It’s also an opportune time to refine your financial blueprint or begin creating one, enabling you to manage your finances more efficiently and make informed financial choices with confidence. While every individual’s financial strategy may vary, understanding some fundamental aspects of financial planning can set you on the path to success.

What Exactly is a Financial Plan?

Think of a financial plan as your roadmap—it provides direction and acts as a compass for your financial decisions. This plan evolves as your life progresses and your needs and goals change. Having a well-crafted financial plan not only reduces stress but also lays a solid financial groundwork for the future.

Key Components of a Financial Plan

1. Current Net Worth Assessment: Begin by taking stock of your assets (bank accounts, investments, properties) and comparing them with your liabilities (debts like loans, mortgages, credit cards).

2. Setting Short- and Long-term Financial Goals: Outline your goals, categorizing them into short-term (within five years) and long-term (ten years or more), and prioritize them based on timelines.

3. Creating a Realistic Budget: Analyze your financial situation to establish a budget, identify areas for expense reduction, boost savings, and optimize income allocation.

4. Debt Management: Address different types of debt strategically, distinguishing between those that contribute positively (ex: mortgages building equity) and those requiring careful management (ex: high-interest credit cards).

5. Emergency Savings: Build a safety net to handle unexpected expenses such as medical emergencies, job loss, or major repairs without dipping into savings or accumulating more debt.

6. Insurance Coverage: Ensure adequate insurance coverage (health, home, auto, life) to safeguard your financial well-being and that of your loved ones in unforeseen circumstances.

7. Integration of Insurance in Your Plan: Understand how insurance complements your financial plan by providing security and financial stability during emergencies, offering predetermined benefits for predictable outcomes.

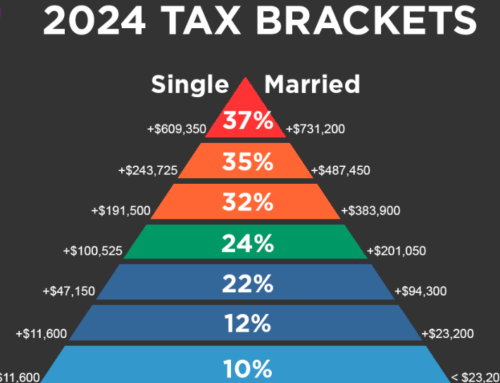

8. Retirement Planning: Start saving for retirement regardless of your life stage, exploring various investment options like 401ks, IRAs, annuities, and other tools to build a diverse retirement portfolio.

Steps to Craft Your Financial Plan

1. Assess Your Financial Status: Gather comprehensive information about your finances, including income, expenses, debts, savings, and investments.

2. Define Your Goals: Clearly outline your short-term and long-term financial objectives, envisioning your financial future.

3. Develop Your Plan: Craft a detailed plan aligning with your goals, incorporating strategies to achieve them effectively.

4. Regular Review and Adjustments: Periodically review your plan, making necessary adjustments to ensure it aligns with your current situation and goals.

Moving Forward with Your Financial Plan

1. Take a Holistic Approach: Get a 360-degree view of your finances, listing all accounts, income, expenses, debts, and savings.

2. Seek Professional Guidance: Consider consulting a financial professional for personalized advice and assistance in creating and executing your financial plan.

3. Implement Your Plan: Put your plan into action by managing your budget, cutting unnecessary expenses, and automating savings to work efficiently towards your goals.

4. Monitor Progress: Regularly assess your progress, correcting your course if needed, and ensure your plan remains relevant and aligned with your vision.

5. Stay Prepared: Embrace changes and life events by updating your plan regularly and conducting an annual financial checkup to stay on track.

Securing Your Financial Future

As you navigate your financial journey and build a fulfilling life, remember the importance of a well-crafted financial plan. It not only supports your current needs and goals but also paves the way for a secure and successful future. At Iowa Retirement Benefits, we are here to provide insights and guidance on integrating annuities and life insurance into your financial plan, enhancing its effectiveness, and helping you achieve your financial milestones.

In conclusion, creating a financial plan is not just about managing money; it’s about shaping your future, making informed decisions, and ensuring financial security. Start your financial planning journey today and empower yourself to reach your financial aspirations with confidence.

Investment advisory services are offered through Fusion Capital Management, an SEC registered investment advisor. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration is not an endorsement of the firm by the commission and does not mean that the advisor has attained a specific level of skill or ability. All investment strategies have the potential for profit or loss.