A Deep Dive into

Annuities

A Deep Dive into Annuities

Posted by Morgan Fisher

Serving Cedar Rapids, Iowa, and Surrounding Areas.

A Deep Dive into Annuities

Retirement planning is a crucial aspect of ensuring financial security. With various investment options available, one strategy that is often discussed with clients are annuities. An annuity is a contract with an insurance company that can provide regular payments to the investor in exchange for a lump sum or periodic payments. Annuities can play a significant role in providing a stable and secure income strategy during your retirement.

When I first bring up the word annuity with a client of mine, I occasionally get backlash.  Many have heard the bad things about annuities-they’re high in fees, it’s hard to get your money out, or it didn’t do as well as their other investments! While that may be true for some annuities, they are not all made equally. My thoughts? There is a time and a place for them. Some of the pros of an annuity include;

Many have heard the bad things about annuities-they’re high in fees, it’s hard to get your money out, or it didn’t do as well as their other investments! While that may be true for some annuities, they are not all made equally. My thoughts? There is a time and a place for them. Some of the pros of an annuity include;

Guaranteed Income: An annuity provides you with a guaranteed stream of income for a specific period of time or for the rest of your life. This can be beneficial to those who are looking for security, knowing that they will receive regular payments regardless of market conditions. (Think of this much like a pension)

Tax Benefits: Annuities offer tax-deferred growth, which means you don’t pay taxes on your investment earnings until you withdraw money, usually after you retire when your income is likely to be lower.

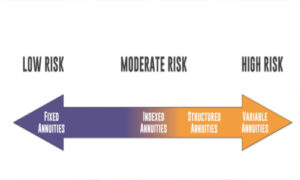

Investment Options: Annuities come in many forms, including fixed annuities, variable annuities, and indexed annuities, so you can choose the one that meets your needs and risk tolerance.

Protection against Market Volatility: Fixed annuities protect you from market loss and guarantee a fixed rate of return regardless of what happens in the market while indexed annuities protect you from market loss and are tied to a specific index. Variable annuities allow you to participate in market gains as well as losses.

Flexible Payout Options: Annuities offer flexibility in terms of payout options. You can choose to receive payments for a specific number of years, for life, or a combination of both. Some annuities also provide the option to include a beneficiary who will continue to receive payments after your passing.

Additional Benefits: Many annuities come with a death benefit, which ensures that your beneficiaries will receive a payout in case of your untimely demise. This can be advantageous if you want to leave a financial legacy for your loved ones. Additionally, some annuities provide benefits for Long Term Care, in the event an individual needs LTC. This can act as LTC insurance. Check out our website where we go into more details on this.

While I have highlighted the many pros to an annuity, they aren’t for everybody. Some of the disadvantages of annuities are;

Access to Funds: Most annuities come with surrender charges if you withdraw too much of your money early, it can be costly.

Long-term Investment: Annuities are designed to be long-term investments, so if you need access to a significant portion of your money in the short term, they may not be the best option.

High Fees: Annuities can be expensive, with fees ranging from 1% to 3% of the investment per year, which can eat into your returns. Typically, high fees are associated with Variable Annuity products.

Complexity: Annuities can be complex financial products, with many different options and features that can be difficult to understand.

So, what does that mean for you? Annuities can be a fantastic option for individuals who are looking for a steady stream of income or a safety bucket in retirement. They are great, for the right situation! Meaning, just because your brother loves his annuity doesn’t mean it’s the best option for you. Typically, if you are looking for some type of safety bucket or income stream, these can be valuable investments for you. However, putting every last dollar you have to your name into an annuity, is typically not a wise choice.

Key Takeaways-

Do your research, meet with a professional. An annuity can be a great vehicle for your money, but it’s not for everybody. If you often need access to the money you are considering placing into this annuity, it may not be a good fit. Vice versa, if you are looking for an income similar to a pension or a safety bucket for your money, this could be a good fit for you. As usual, I always recommend you talk to a professional at Iowa Retirement Benefits & Solutions prior to concluding if an annuity is right for you.

Written by: Morgan Fisher

Investment advisory services are offered through Fusion Capital Management, an SEC registered investment advisor. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration is not an endorsement of the firm by the commission and does not mean that the advisor has attained a specific level of skill or ability. All investment strategies have the potential for profit or loss.